Investors are optimists — seeing the glass as half-full — when it comes to US corporate earnings for 2020 and 2021. Yes, a drop of nearly 40% is expected in S&P 500 earnings for the 2nd quarter of 2020, with revenue down around 10% (vs. same quarter last year). But these really bad results are supposed to be rock bottom. From here on, steady improvement in US corporate profits is expected for the rest of the year and into next. Hence stocks could theoretically avoid a downturn based on ongoing monetary and fiscal stimulus until a Covid-19 vaccine fights off the pandemic.

However, lots can happen between now and then. LNWM CIO Gino Perrina points out in our Q3 2020 Economic Outlook:

“We do not expect global output to recover to 2019 levels until the end of 2021. Between now and then, the markets are anticipating steady improvement in the economy and corporate profits. Disappointment could be destabilizing.”

What would disappointment look like? Numbers that are worse than the consensus. The consensus now is that S&P 500 earnings will be down 21% for all of 2020 with revenue off by around 3%. Profit margins have fallen to around 7%, a level last seen 4th quarter 2009, but are also expected to rebound over time closer to the 10% average for the past five years. And 2021 is expected to actually show growth in corporate earnings of about 28%. These are not great results, to be sure, especially since corporate profits were flat — zero growth — in 2019. But again, the focus is on improvement. And there could be stronger results if a viable Covid-19 vaccine is released and used to eliminate the pandemic.

THE TAX FACTOR

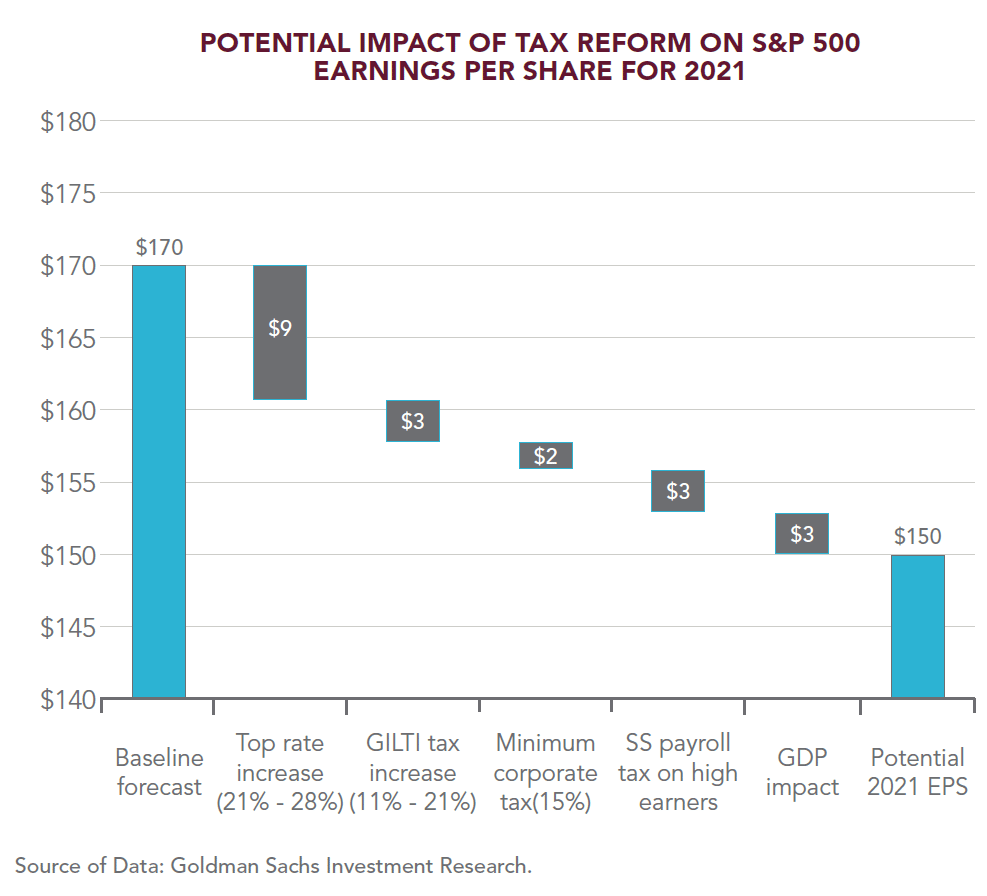

One factor that has not been considered: higher corporate tax rates, which have been proposed by the presumptive Democratic nominee Joe Biden. If the November elections lead to a Democratic sweep (control of the White House and Congress), taxes on corporations are likely to rise in a variety of ways. This includes the highest corporate tax rate rising to 28% (from 21% currently) as well as a 15% minimum tax. The combined impact of all these proposed measures is estimated to reduce 2021 earnings per share for S&P 500 companies to $150 (from $170), a 12% decline, which we don’t believe is fully priced in by the markets currently.