Infrastructure is again a buzz word, as $1 trillion in new spending on infrastructure is close to being approved by the US Senate. For quite a while, we have included in many client portfolios funds that invest in infrastructure-related companies — utilities, transportation, communications, and energy transmission — because as essential service providers with limited competition, they tend to have relatively stable earnings and income streams.

Based on conversations we’ve had with asset managers who specialize in infrastructure, the biggest short-term beneficiaries of the the current Senate bill are likely to be government contractors (construction companies, consultants, etc.) since most traditional infrastructure assets (roads, bridges, public transit) are owned by federal or state entities. Longer term, a major opportunity within infrastructure is the global shift toward renewable energy/decarbonization, driven by greater demand for electricity and data connectivity.

Clean Energy Future

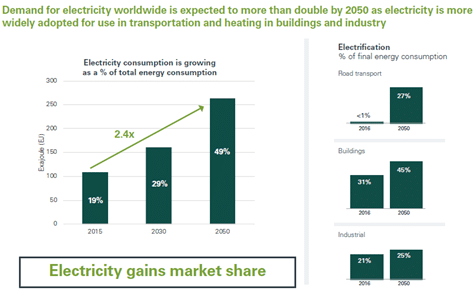

There are two key reasons renewable energy is on the rise: Renewable power – wind and solar – is carbon-free, and it is now the world’s cheapest source of energy, with the cost of production plummeting during the past decade. Public subsidies are no longer needed for renewables to compete with traditional sources (oil, gas, hydro, nuclear). As a result, renewable energy is expected to provide 60% of the world’s electricity by 2050 vs. just 9% today.

Here in the US, about 38% of electricity production currently comes from non-carbon sources. Of this, 20% is nuclear, 11% solar/wind/biomass, and 7% hydroelectric. If decarbonized power is to reach the goal of 80% of total US generation, basically double the current output, there will need to be at least 5X growth in solar/wind/biomass output since there are environmental concerns about the other two clean energy sources: nuclear and hydroelectric. Over a 10-year period (which would be rapid deployment), an increase of 5X would amount to 17.5% annualized growth in renewables use with no additional electricity demand.

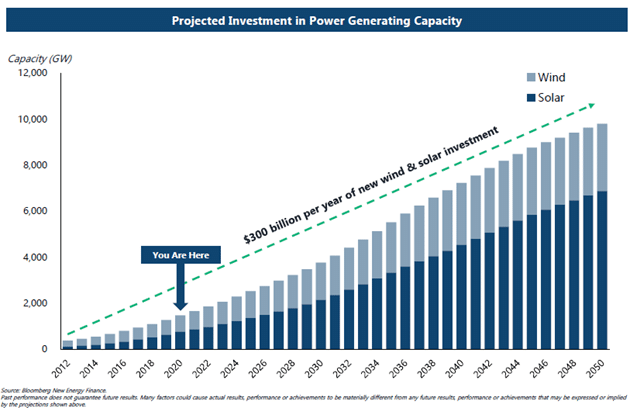

At the same time, the electrical grid — from power generation to distribution and storage — is evolving to meet growing demand and will require substantial investment. The International Renewable Energy Agency estimates as much as $100 trillion in grid investments will be needed globally over the next three decades.

In the $1 trillion infrastructure bill now in the US Senate, $73 billion is allocated to US power and electronic grid updates. This is a small start given the massive strain on electricity distribution as cars and trucks, buildings, and industrial machinery increasingly rely on electricity. Much more investment will be required, especially for new facilities that can store and deploy renewable energy, which is not accessible at all times (lack of wind, sun).

Don’t Write Off Electric Utilities

Based on our discussions with asset managers, some of the best long-term opportunities in infrastructure are in publicly traded electric utilities. Utilities are among the biggest emitters of carbon dioxide and other greenhouse gases currently, but this could change significantly in the coming decade. The reason: If a utility decommissions its coal plants over time and increases its reliance on low-cost renewables, it can greatly lower its operating costs and increase its operating profit.

An example one manager noted was Xcel, which is investing in renewable power generation while retiring old thermal plants. Given these are regulated entities, Xcel can charge customers for the sunken costs when closing coal-burning plants, and for the cost of investing in renewable power sources.

Although utilities will be required to pass on cost savings from renewable energy on to consumers, their bottom lines will benefit as well. We are entering an era when the shift to renewable energy can be a win-win for the environment and companies making the switch.

Source: McKinsey; Irena, June 2020, Renewable Power Generation Costs in 2019.