April is a time of renewal, and this year more than ever. A global pandemic and the rising toll of climate change have put more focus on what we can do now to live more sustainably. I think that’s a major reason there’s been in surge in interest in sustainable investing over the past year, and this trend is something we expect to continue.

For close to 20 years, LNWM has been helping foundations — and increasingly families and individuals — invest their portfolios in line with their values, be it protecting the environment and/or addressing socioeconomic issues.

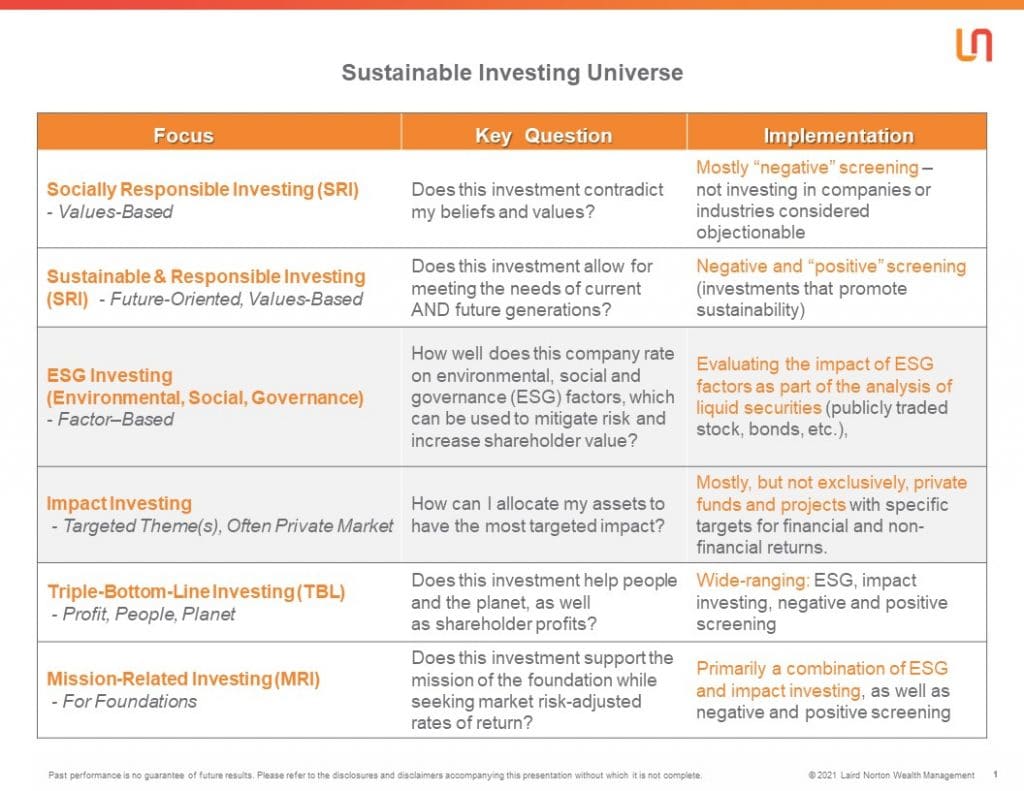

When we start to work with clients to align portfolios with non-financial priorities, we find that many have been confused for quite a while by all the different terms used around sustainable investing. That’s not surprising, since there’s no standardized way to talk about sustainable investing and the various ways to do it.

To avoid confusion and make sure we’re all working off the same page (with each other and with clients), we have developed a framework and definitions for sustainable investing terms that others might find useful as well.

Toward a Unified Language

Here at LNWM, we use “sustainable investing” as the umbrella term that comprises a variety of approaches. Sustainability balances demand for resources/capital with what is good in the long run for the environment and society as a whole. To invest sustainably means to invest for both financial and non-financial goals, and as more people do this, it opens up opportunities for global capital markets to encourage/incentivize positive change and innovation in addressing:

- Environmental challenges – Climate change, sustainable and scarce resources and access to those resources

- Social challenges – Social justice and equity, education, access to capital, affordable housing

- Governance challenges – How corporations operate and behave

The tricky part is all the different approaches under the sustainable investing umbrella, some of which sound alike and many of which are used interchangeably — from socially responsible investing (SRI), to ESG, to impact investing. What’s the difference? We distinguish among these approaches by centering on the key question/intent of each. The table below provides a summary:

Some Key Distinctions

***Socially Responsible Investing (SRI) or Values-Based Investing. Here, people want their values and preferences (i.e. issue areas) to drive what’s in their portfolios. This approach tends to focus on “negative” screening—NOT investing in companies or industries believed to be detrimental to sustainability. Related but different is Sustainable & Responsible Investing (also SRI), which includes “positive” screening to focus on companies working toward sustainability. In both cases, investors are aiming for return but not at the cost of the non-financial issues important to them.

***ESG Investing. ESG is not about investor values or priorities. It refers to the integration of non-financial environmental, social and governance factors as part of an investment manager’s decision-making process to identify risks and growth opportunities that can affect shareholder value.

***Impact Investing. The key aspect of impact investing is intentionality as to both financial and non-financial outcomes, with goals that are defined in advance and measurable in some way. Typically, impact investing is done through the private markets (private debt, private equity), although some publicly traded funds incorporate aspect impact investing.

***Triple Bottom Line (TBL). TBL posits that instead of just one bottom line for an investment (profits), there should be two more — people, and the planet. A TBL focus means gauging an investment’s commitment to corporate social responsibility and impact on the environment over time.

Onward and Upward

You will no doubt read articles and reports containing different definitions than the ones shown above. That is OK. It is important to accept the evolving nature of the language and embrace the discomfort of overlapping terms, inconsistencies, etc. We have developed our own in-house terminology to avoid confusion as the space continues to evolve.

More importantly, overlapping terms and definitions should not be a deterrent to investing according to values and priorities. This can be done successfully but it does require a deliberate strategy based on thorough research and analysis.

Before recommending any type of sustainable investing vehicle to clients, we do extensive due diligence on the actual holdings, the rationale behind each, and how closely that matches with each client’s goals, both financial and non-financial. We are encouraged that there are now more sustainable investing options than ever, as sustainability is increasingly seen as a driver of both risk and return. In the next decade, we think sustainability analysis will become a routine part of investment and financial decisions, driving standardization in both the terminology and data sources.