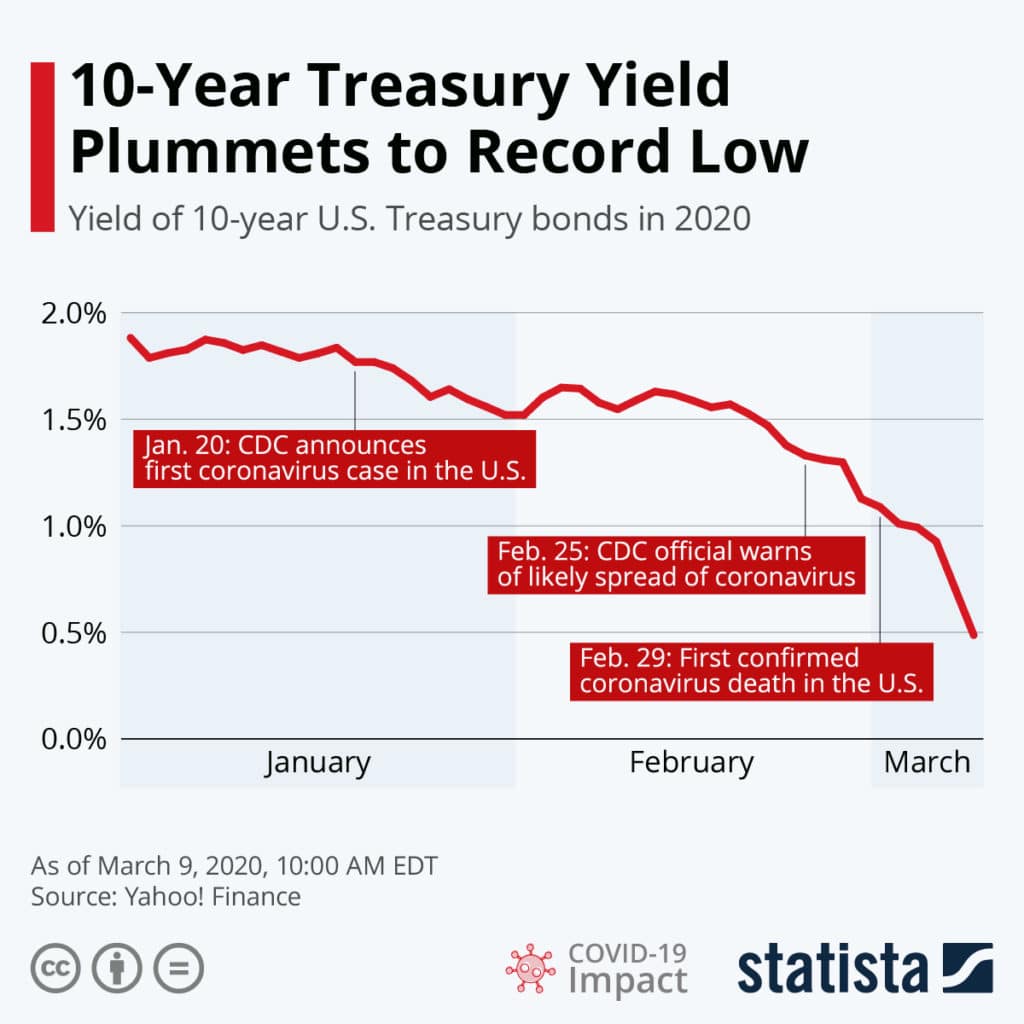

Here’s a bit of March Madness for you: the yield on ALL Treasury bonds is now 1% or less. That’s right: the 10-year Treasury bond is now yielding below 0.6% and the 30-year roughly 1%. The precipitous drop in yields to “zero dot” levels has fueled a huge rally in high-quality bonds, providing a cushion for diversified portfolios and those who can refinance debt. But it’s not good news for money market savers or the outlook for the US economy.

To find out what this all means, we sat down with David Baker, Director, Investment Strategy & Research at Laird Norton Wealth Management.

Q. Dave, what has caused this historic drop in US government bond yields?

DB: Mainly fear about the economic impact of coronavirus. It’s a flight to quality and security. Secondarily, there is the factor of US banks adding to their capital reserves by buying Treasuries and derivatives in order to offset income loss from the big wave of mortgage refinancing as rates have fallen.

So now we have Treasury bond yields that are below the short-term interest rate target of the Federal Reserve, currently in the range of 1% to 1.25%. I actually think the Fed’s 50 basis point cut in its target rate in early March had the opposite effect of calming the markets — it spooked everyone, with the S&P 500 down 3% that day.

The drop in Treasury yields is flashing an orange light for the economy. It is indicating that the market expects the Fed to cut rates a lot more to fight off recession. For the Fed’s next meeting on March 18, the markets are pricing in an additional 75 basis point cut, and we think eventually the Fed funds rate could go down to zero.

Q. Are we going to see negative interest rates in the US?

DB: Zero is probably the end of the line for the Fed funds rate, where it was during the 2008 financial crisis. Going to negative rates is a choice of last resort for the Fed, I think, but it is not out of the question. For many years now, the Eurozone and Japan have had negative rates, although not on consumer deposits (people are not yet actually paying banks to keep their money safe). The problem is that negative rates have not really helped to boost economic growth. And there are a variety of other reasons to avoid negative rates.

Everything we know about the financial system is based on a positive risk/reward trade-off, so when interest rates are negative, financial decision making can be both backward and distorted. Like a funhouse mirror, as I said in a blog post back in November. With negative rates, debt becomes an asset for consumers and a liability for banks, borrowers have no reason to pay back debt early, and while banks are still rewarded to lend, they have to worry about retaining deposits since people may not want to pay banks to store their money.

Q. What would cause US rates to drop below zero?

DB: I think an accelerated economic slowdown, with concrete evidence that the coronavirus will have a longer lasting impact on GDP growth than anticipated at this point. On top of that, a liquidity crisis in corporate credit and/or a lack of effective fiscal stimulus by the government could be other factors that force the Fed’s hand.

We are tracking a number of data points for that evidence. While the unemployment rate and new job growth have held up well, they aren’t particularly great at forecasting where we are headed. More important for forecasting are leading indicators, such as consumer and business confidence and corporate earnings expectations. And we are also keeping a close watch on building permits and construction activity, which had picked up at the end of 2019.

It’s still possible that the US economy could end up growing overall in 2020, after one of two quarters of shrinking. It can take several months, but lower interest rates will eventually make it down to the consumer level and benefit people as they refinance mortgages, auto loans, student loans and other debt.

Q: How’s the corporate bond market holding up?

DB: Not particularly well, especially now with the big drop in oil prices on Monday. Roughly 11% of the high-yield bond market is made up of oil or otherwise energy related companies. It is safe to say that we will see defaults in the high-yield sector, since $30 per barrel is not profitable for a number of these companies. High-yield bonds have now lost roughly 6% year-to-date.

But for higher-quality corporates (rated BBB and above), pricing has held up relatively well and only in the last few days started to show some weakness. While investment-grade companies certainly took advantage of low rates to increase debt relative to equity, the fundamentals don’t tell a unifying story. Many companies, if they wanted, could pay off debt with cash on hand, increasing their ratings from BBB to A. The investment-grade part of the corporate market seems OK for now. However, we are monitoring financial market liquidity, which has been stressed in the last few weeks and can be an indicator of difficult times to come.

Q. What is LNWM’s positioning within fixed income?

DB: Over the last 18 months, we have been adding more to what we call “core” fixed income, which is high-quality investment-grade corporate bonds, agency mortgages, Treasuries and municipal bonds, all of which typically perform well in equity market selloffs.

We have been adding mostly to our taxable fixed-income exposure. That’s because tax-advantaged munis are in the front lines, so to speak, when it comes to combating coronavirus. As state and local governments deal with the virus fallout, it could reduce tax revenue and put a strain on their budgets. To a lesser extent, we’ve also allocated to positions we categorize as “multi-strategy fixed income” to diversify our exposure. These strategies are geared to add value if interest rates stay where they are or rise.

Q. What can derail the bull market in bonds?

DB: If the spread of coronavirus starts to slow outside of China, if it were contained, then interest rates could bounce back up quickly. The further rates fall, the more painful that bounce up might be. If the situation improves more quickly than anticipated, the 10-yield could go back up to 1.9%. That seems like a big move from where we are today until you remember that is where we started the year, just a few months ago. So, you want to have some cushion if rates go in the opposite to zero, which is why we include multi-strategy positions. Still, our base case is for rates to remain low for the next several months as the virus impact works its way through the system.

We want to caution people not to make wholesale portfolio changes and over-invest in bonds, especially since we really don’t know what the ultimate coronavirus impact will be. Bonds are a good source of ballast at times of falling stock markets, but they can also lose value quickly if things turn out less dire. So, stay diversified. While we think coronavirus is a serious market and economic threat, it will have a finite impact that will be known before too long. Our Investment Strategy & Research team is looking ahead to that time and trying to position portfolios for the continued downside as well as success in the eventual recovery.