March 2020

US Economy: Not robust but stable.

The index of leading economic indicators (+0.8% monthly increase) and construction activity (+1.8%) surprised to the upside in Feb., while the ISM surveys of the US manufacturing and services sectors remain roughly neutral (not expanding or contracting), suggesting the new coronavirus COVID-19 is hitting the US at a time of economic stability.

US Stocks: A volatile February.

At the end of the month, US equities had their worst weekly drop since 2008 (down 11.4% for the S&P 500), erasing Jan. gains, as the new coronavirus became a global concern and China’s economy weakened. Analyst estimates for 2020 S&P 500 earnings growth have dropped but remain positive, ranging from flat to up more than 7%.

Foreign Stocks: EM stocks surprise.

Non-US equities also tumbled in Feb., although emerging markets (EM) outperformed developed markets. EM stocks were somewhat insulated by signs that the spread of coronavirus is slowing in China, relatively attractive valuations, and a generally smaller role in investor portfolios.

Fixed Income: Yields hit historic lows.

The yield on 10-Year US Treasuries fell to around 1%, as investors plowed into safe-haven assets and the Federal Reserve cut rates by 50 basis points in early March, with another two cuts now expected in 2020. In the past 12 months, high-quality bonds have outperformed stocks.

Real Assets: Weakening outlook.

Real assets weren’t spared the red ink as infrastructure, oil transport, toll road and airport operators understandably fell on weaker global growth and travel expectations. Commodities offered portfolios a measure of diversification driven by soft goods (coffee, sugar) and agricultural products.

Alternatives: Modest contributors.

Hedge funds generally outperformed equities. Relative-value strategies were flat for Feb., while macro and event-driven strategies outperformed. Given the weakness in equity markets, long-short equity strategies were down 3.8% on average, which is considerably less than the drop in US stock market indexes.

Equities Total Return

| FEB | YTD | 1 YR | |

|---|---|---|---|

| U.S. Large Cap | (8.2%) | (8.3%) | 8.2% |

| U.S. Small Cap | (8.4%) | (11.4%) | (5.0%) |

| U.S. Growth | (6.8%) | (5.0%) | 13.9% |

| U.S. Value | (9.7%) | (11.8%) | (0.2%) |

| Int’l Developed | (9.0%) | (10.9%) | (0.6%) |

| Emerging Markets | (5.3%) | (9.7%) | (1.9%) |

Fixed Income Total Return

| FEB | YTD | 1 YR | |

|---|---|---|---|

| Taxable | |||

| U.S. Agg. Bond | 1.8% | 3.8% | 11.7% |

| TIPS | 1.4% | 3.5% | 10.8% |

| U.S. High Yield | (1.5%) | (1.5%) | 5.9% |

| Int’l Developed | 0.2% | 1.3% | 5.6% |

| Emerging Markets | (0.2%) | (0.0%) | 5.5% |

| Tax-Exempt | |||

| Intermediate Munis | 0.5% | 1.8% | 5.7% |

| Munis Broad Mkt | 1.4% | 3.2% | 9.7% |

Non-Traditional Assets Total Return

| FEB | YTD | 1 YR | |

|---|---|---|---|

| Commodities | (5.0%) | (12.0%) | (11.1%) |

| REITs | (7.0%) | (5.8%) | 8.0% |

| Infrastructure | (9.5%) | (8.1%) | 4.9% |

| Hedge Funds | |||

| Absolute Return | (0.3%) | (0.3%) | 2.9% |

| Overall HF Market | (1.4%) | (1.0%) | 4.6% |

| Managed Futures | (1.5%) | (0.7%) | 7.1% |

Economic Indicators

| FEB-20 | AUG-19 | FEB-19 | |

|---|---|---|---|

| Equity Volatility | 40.1 | 19.0 | 14.8 |

| Implied Inflation | 1.4% | 1.5% | 1.9% |

| Gold Spot $/OZ | $1586 | $1520 | $1313 |

| Oil ($/BBL) | $51 | $60 | $66 |

| U.S. Dollar Index | 116.8 | 117.1 | 114.3 |

Our Take

The most significant development in the past week, and what proved to be the tipping point for financial markets, are expectations that the new coronavirus, COVID-19, is likely to spread further around the world, including the US. It is now clear that the problems posed by COVID-19 are not going to be resolved in the next few months, despite early hopes.

The latest reports indicate COVID-19’s overall mortality rate is not as high as that of other coronaviruses (SARS, MERS), but it is higher (3.4%) than the flu (less than 1%). Also, it has a longish incubation period (up to 2 weeks) and its symptoms mimic those of the seasonal flu. So it is challenging to diagnose and contain. While vaccines are being developed, testing them can take many months.

What makes the new coronavirus most problematic for the economy is somewhat counterintuitive. That’s because efforts to contain and stop the virus — by governments, companies, and people – can create a compounding drag on the economy and financial markets, especially in an inter-connected and globalized world. Consumers hunker down, businesses face production shortages, and governments restrict travel and large gatherings.

Because of the potential impact on both consumer spending and the global supply chain, and by extension corporate profits, we view COVID-19 as a serious threat to US and global growth.

The Outlook

A bit of good news is that the rate of coronavirus infection seems to be slowing within China and more people are slowly getting back to work there. This is encouraging, given that China is the world’s 2nd largest economy (about 16% of global GDP) and is key to the supply chains of many US companies, from big tech to pharmaceuticals. It could be that February 2020 will end up being the worst month in terms of China’s economic performance, with both manufacturing and services activities showing steep contraction.

This comes with two major caveats: (1) Can data from China be trusted? When it comes to coronavirus infections, perhaps yes. Epidemiologists from the World Health Organization (WHO) are in China and they seem to be validating the data, which show infections slowing there.

(2) Will containment efforts outside of China – in South Korea, Europe, Japan and the US — drag out and deepen the global economic impact? It is hard to imagine many governments doing what China did, the equivalent of quarantining an entire US state. But there will be a rising amount of containment efforts, which governments should be prepared to offset with stimulus spending, as Italy is doing now.

Economic Impact

Heading into March, we are starting to see the impact of coronavirus on the demand for certain services (less travel, tourism, shopping, eating out, etc.) as well as disruptions in the supply chains of hundreds of US companies, who source some or all their products globally, especially from China.

We are tracking US consumer spending closely, since this powers nearly 70% of US GDP. If US consumers are not spending as much and businesses are facing production issues, overall growth in corporate earnings could stall. Because equity markets are still pricing in S&P 500 earnings growth for 2020, a drop in earnings would be negative for stocks. How much further equities might fall from here depends on how much consumer spending is affected and what kind of US government (fiscal) stimulus we see in response.

At this point, we do not anticipate the coronavirus impact will tip the US into recession (defined as GDP falling for at least two consecutive quarters), and global economic growth is expected to average around 2.3% for 2020. We think central bank support, like the recent 0.5% interest rate cut by the Federal Reserve, will help, even if lower interest rates won’t limit the spread of the disease or repair broken supply chains. Actions by central banks, coupled with government spending, can improve financial market liquidity and support both consumer and business confidence to some extent.

Portfolio Positioning

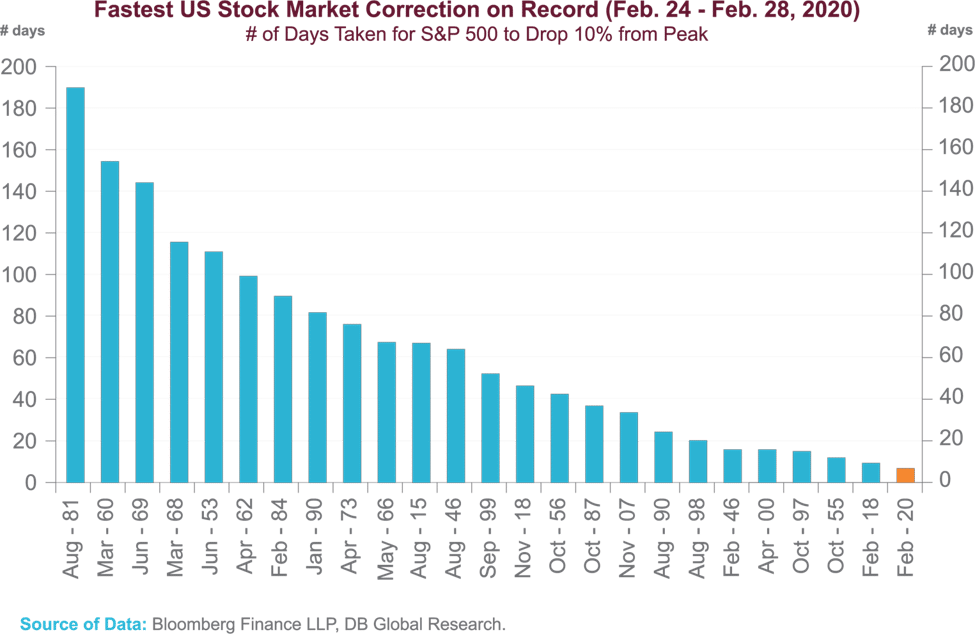

Fast and furious was the drop in the S&P 500 during the week of Feb. 24. In fact, this was the fastest correction (drop of 10% or more from peak) on record for US stocks (see chart below). We expect volatility to remain high this year (although maybe not at recent levels), given the greater uncertainty caused by coronavirus, the upcoming US Presidential campaign and election, and ongoing geopolitical tensions (escalation in Syria, Iran, North Korea).

Higher market volatility is something that LNWM portfolios are created to deal with, primarily by being well-diversified but also due to the risk reduction measures we have been taking throughout the past year. While we are not making major changes to our portfolios at this time, last week we eliminated our small allocation to commodities, which we view as among the most susceptible asset classes to slowing global growth. We used the proceeds to increase our allocation to fixed income, which we believe reduces our near-term risk. That said, our understanding of the impact of coronavirus, the US presidential race, and other uncertainties continues to evolve daily. We remain vigilant, prepared to take additional steps should they become necessary to further bolster portfolios.

Sign up for our monthly Economic Flash email to get the latest insights delivered right to your inbox.