Earlier this week, LNWM CIO Ron Albahary, CFA® sent an email to clients outlining our latest thinking on market developments.

Below is an excerpt:

———————————————————————————————————————————————-

The market volatility we had envisioned for this year shows no sign of abating. While I have been writing frequent market updates to client advisory teams, I felt this was a good time to reach out to you and our other clients directly. Having navigated markets for over 30 years, I know how important it is for us to proactively communicate with you during times of turbulence, as conflicting headlines designed to raise anxiety abound.

Let’s put the news aside for the time being and focus on what really matters: how market developments might affect you being able to attain your long-term goals. As of June 6, the S&P 500 was down over 14% from its peak; high-quality bonds have had some of their worst results in decades, down nearly 10% so far this year.

Naturally, you may be asking: “What should we be doing?” When markets move significantly (both up or down), behavioral biases and emotions kick in, compelling humans to feel they must take action. But as I will explain, this is not a time for radical changes to our portfolio strategy.

PERSPECTIVES ON VOLATILITY

During periods of extended downside volatility, there’s a higher chance you yourself will feel compelled to do something, to take action. Keep in mind Morgan Housel’s counsel in his book The Psychology of Money: “Good investing is overwhelmingly just about how you behave. It’s about your relationship with greed and fear, how gullible you are, who you trust, who you seek your information from, your ability to take a long-term mindset, long-term time horizon.”

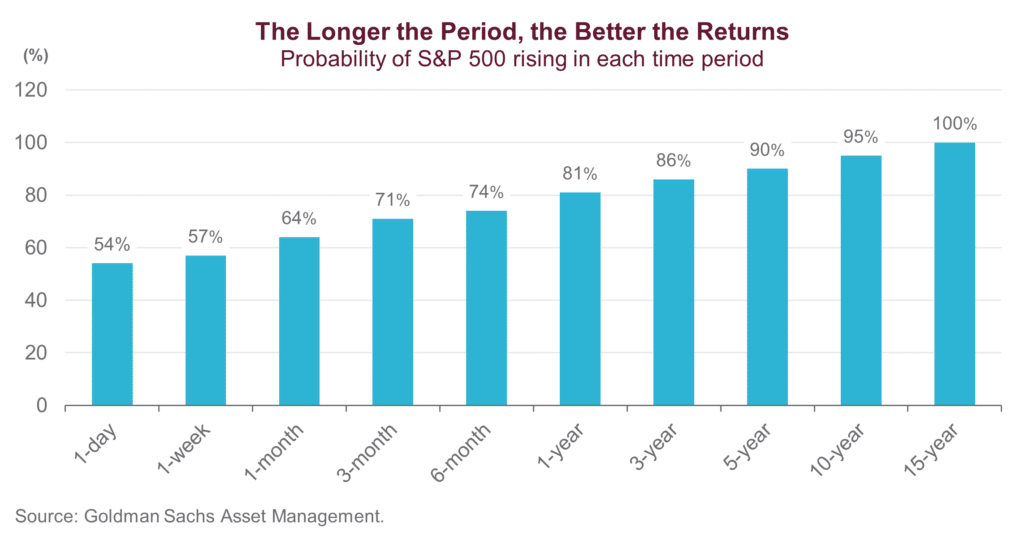

Staying invested for the long term and not reacting to the noise stacks the odds in your favor, as evidenced by the chart below.

CURRENT RISKS

A potential policy error by the Federal Reserve remains a top concern as we look out at 2022. By that, we mean the Fed tightening monetary policy too much, too quickly, triggering a recession.

The risk of a US recession has certainly risen since March. Unlike it may appear in the media, recessions are a necessary part of the normal business cycle, washing out excesses and resetting the economy and markets to focus on fundamentals. Technically, we may already be in recession, if GDP growth proves negative in Q2.

Recessions tend to deepen equity market selloffs, and as such we are analyzing a broad range of factors, which admittedly present a mixed picture.

- Liquidity and credit conditions. Yields on long-term bonds are back to being higher than on short-term bonds. Optimistically, this could mean the effects of the Fed’s tightening are beginning to be felt, and we may see the Fed pull back on aggressive rate increases at some point this year. The credit market, which generally acts as a good leading indicator, is telling a different story; it continues to show signs of stress, with bond credit spreads rising back to 2020 levels.

- Inflation is high, but there are signs it may have peaked. The prices of food, oil, and other global goods tend to respond relatively quickly to additional supply. So, while there’s lot of pain around food and energy pricing, these components could see price declines as supply issues are resolved over time. In fact, we are seeing early signs of repair in supply chains. More concerning is that we’ve had rising prices in housing and wages, where pricing is “sticky” and does not change quickly.

- US consumer debt and spending. As a whole, consumers are in good financial shape. Our concern here is the low and middle-income segment, which appears stressed. The percentage of subprime credit cards and personal loans delinquent 60 days or more has risen six months straight, while the higher cost of essentials (food, energy, shelter) is crowding out discretionary purchases.

- Corporate earnings. Equity valuations are now more in line with the past. The S&P 500 was recently priced close to its 10-year average, at 17 times forward earnings (much better than the 22 times it was earlier this year). Of course, actual earnings could be lower-than-expected later this year, given a strong dollar, higher input costs including labor, and potential shifts in consumer spending. So, we are keeping a watch on changes to earnings estimates.

WHAT WE ARE DOING

Re-underwriting all our approved strategies. This is not a time to get complacent. We expect the managers we have hired to be actively managing risk as well as taking advantage of opportunities. Underperformance relative to benchmarks is not necessarily a reason to terminate a manager if they are sticking with their discipline and performing in line with the expectations we established when we hired them.

Rebalancing with discipline and on a regular basis has been shown to mitigate the risk of emotional decisions and to achieve a “buy low/sell high” dynamic in portfolios. Mind you, this is not market timing – it’s simply sticking with your investment business plan, which requires regular rebalancing.

Tax-loss harvesting opportunistically, including in fixed income, can drive tax-generated alpha (more dollars in your pockets after taxes) for many years to come. It was not that long ago that most clients had exhausted their carryforwards from years back and had so many gains that shifts in portfolios were constrained by tax concerns.

Emphasizing exposures to less-correlated investments is crucial in these volatile periods, as they can act as relative ballasts in the face of selloffs.

Ensuring clients have sufficient cash reserves for their intermediate-term liquidity and/or spending needs (the amount depends on your personal financial plan).

OPPORTUNITIES

In volatile markets, opportunity is created when greed becomes fear and asset prices are dislocated from their fundamental LONG-TERM value. Long before the 2022 upturn in volatility, we had done the hard work of developing an asset allocation for your portfolio that is calibrated to your needs, as well as your ability and desire to take risk to achieve your goals. We have also populated your portfolio with a variety of diversifying ingredients – some of which are active strategies that can capitalize on pricing dislocations. Where might some of these opportunities be?

Foreign equities. Valuations in both developed and emerging markets are now compelling relative to the US and relative to their own history. More recently, European and emerging market stocks have experienced a stronger rebound off the March lows; in the latest leg lower, they haven’t seen as sharp of a decline. Europe’s dollar-adjusted STOXX 600 Index is actually now back above its March lows while the S&P 500 remains below that key level. In addition, exposure to leading European and Japanese equities can provide a broader range of diversification across sectors versus the highly concentrated, technology centric US markets.

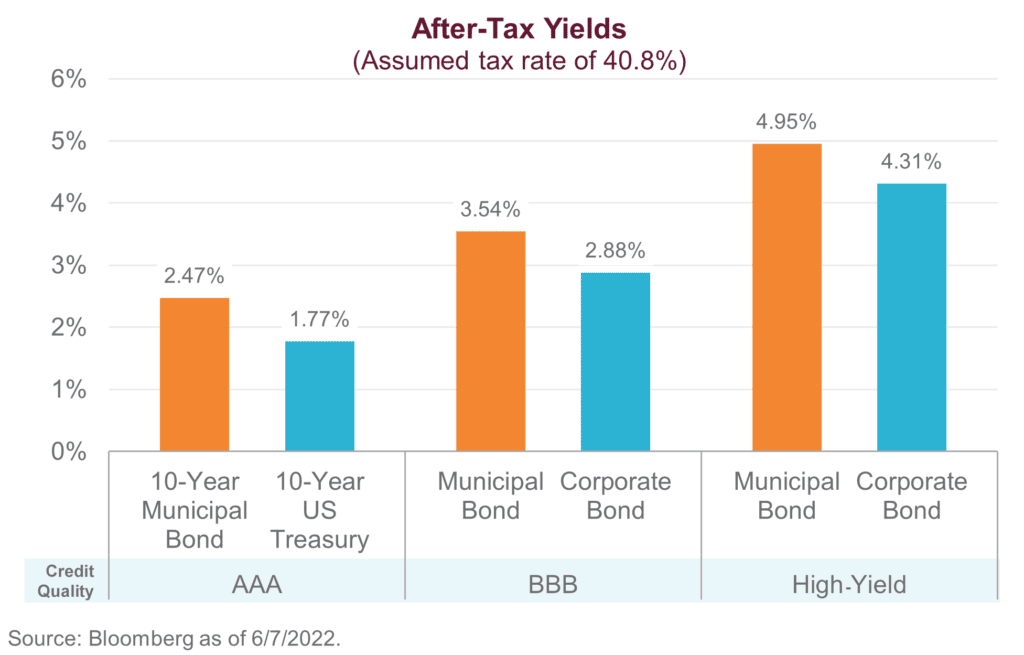

Municipal bonds. Two positive developments here: State and local governments emerged from COVID-19 generally in good financial shape; and the tax-equivalent muni yields for investors in the highest marginal tax brackets are now at levels not seen in a long while.

Being a liquidity provider. The vast majority of our clients can afford to be liquidity providers just when most investors are looking for the exits. In particular, private market strategies should benefit from general risk aversion and the repricing of risk assets, allowing managers to structure transactions at better valuations/terms.