Our Chief Impact Officer Justina Lai recently conducted a presentation on the state of impact investing for the combined teams of Laird Norton Wealth Management (LNWM) and our sister company Wetherby Asset Management (WAM). Justina discussed major developments in 2022, themes to watch in 2023, and what all this means for client portfolios. Below are some of Justina’s key points:

- Despite setbacks (or perhaps because of them), 2022 highlighted the importance of impact investing

In 2022, impact investing faced real challenges and threats for the first time. But these challenges also highlighted how critical impact investing has become and gave the industry the opportunity to demonstrate its resilience and value.

Russia’s invasion of Ukraine precipitated a global energy crisis. While it accelerated short-term investment in some replacement fossil fuels, the crisis also fast-tracked efforts to replace fossil fuels with renewable energy, storage and efficiency measures. Renewables are now not only the cheapest and cleanest forms of energy but also boosting energy security as well.

In 2022, some US state governments including those with major fossil fuel industries (e.g., Texas, West Virginia, Florida) sought to restrict the use of ESG (environmental, social, governance) considerations by the investment managers of state pension funds when analyzing investments. While Justina believes challenges to ESG and impact investing will continue due to the threat they pose to vested interests, she believes that legislators ultimately will not be able to stand in the way due to the financial materiality of ESG-related risks and opportunities.

- Demand for impact funds remained resilient

The strong performance of energy stocks and massive losses in the tech sector led public impact funds to slightly underperform traditional funds for the first time since 2018. Despite these challenging market conditions, US impact funds saw net positive flows of $3 billion, while traditional funds experienced more than $370 billion in withdrawals in 2022. (Source: Morningstar.)

Over longer periods, impact funds, including nearly all of our active impact equity managers have, on average, outperformed their respective benchmarks. Sustainable fund launches also remained strong, with 98 new US sustainable funds launched in 2022. The merger of LNWM and WAM has greatly expanded the line-up of impact strategies available to our clients, with now over 50 impact funds and separately managed accounts (SMAs) across the combined platform.

- Clean technologies have reached a tipping point, reflected in major milestones in energy transition investments

Nearly 90 countries now draw at least 5% of their electricity from wind and solar, a tipping point for widespread adoption. (Source: Bloomberg.com). The International Energy Agency says fossil fuel use in the power sector has likely peaked and projects that 90% of new electricity expansion will be renewables by 2025. Electric vehicles (EVs) now represent 9% of car sales worldwide and a quarter of new car sales in the US could be electric by the end of 2025.

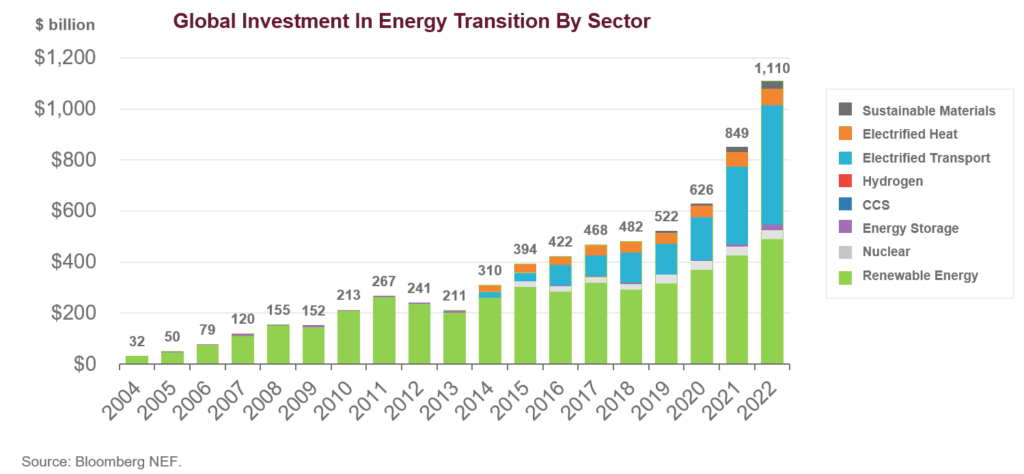

Last year, for the first time ever, the amount of new investment in the energy transition EQUALLED the amount invested in fossil fuels: $1.1 trillion. Renewable energy, electrified transport and six other energy transition sectors all set annual investment records in 2022. Please see chart below; CCS = Carbon Capture & Storage.

Here in the US, climate technologies will get a boost from the Inflation Reduction Act (IRA) signed into law in 2022. The law provides close to $370 billion in incentives and tax breaks for renewable energy, EVs and heat pumps and speeding the development of new technologies, such as hydrogen and sustainable aviation fuel. All these efforts combined are expected to reduce greenhouse gas emissions by 4 billion tons by 2030 (a 40% reduction from 2005 levels) and create more than 9 million jobs over the next decade.

We offer our clients numerous ways to invest in investment strategies that contribute to the energy transition and will continue to participate in the growth in climate technology during this decade and beyond.

- Shareholder activism is viable and growing

Last year, 282 ESG-related shareholder resolutions went to a vote with 34 of achieving majority support, a sign of the ongoing pressure on companies to meet expectations on issues such as climate change and workforce diversity. The proposals help companies understand ESG best practices; address material issues that impact workers, customers, communities and climate; and raise awareness of new impact issues.

For the 2023 annual meeting season, our clients have signed authorization letters to file/co-file/support 92 shareholder resolutions at 64 different companies.

Looking Ahead

For 2023, Justina and our impact investing team foresee these developments, which they consider net positives overall:

- Clean tech competition heats up: The size of the US economy and the scale of the Inflation Reduction Act (IRA) subsidies are forcing European lawmakers to try and match the US incentives. Even as the US and the EU navigate this new competition, they both share a bigger rival in China. China holds the lead on almost every green technology as the world’s largest producer of solar panels, batteries, EVs and hydrogen-producing electrolyzers. The IRA’s incentives are designed to minimize China’s role and try to break its hold on key climate technologies such as the EV battery supply. This competition represents an opportunity to drive greater innovation and clean technologies faster and at larger scale.

- Growing emphasis on biodiversity, natural capital and water: Investors will move more rapidly toward addressing biodiversity issues as there is no viable path to decarbonization without major investments in natural capital, an estimated $10 trillion annual market opportunity. The new Global Biodiversity Framework adopted at COP15 will require large financial institutions to monitor, assess and disclose their risks and impacts on biodiversity. While investors are starting to recognize that biodiversity and climate are inextricably linked, investors do not yet recognize the portfolio risks presented by water-related issues. This year, greater investor focus on water is expected, with the UN set to hold a dedicated water conference in March.

- Greenwashing concerns will (hopefully) begin to recede as regulators act: Global regulators have launched greenwashing investigations into several major companies, looking for gaps between what they claim in their filings and their actual practices. Europe is addressing greenwashing through its Sustainable Finance Disclosure Regulation (SFDR) which imposed mandatory ESG disclosure rules. Amidst these stricter rules, fund managers have stripped ESG labels from hundreds of funds and downgraded “dark green” Article 9 funds to the less stringent “light green” Article 8 category. This reset in the market is likely to play out across the world as the US SEC considers tougher regulations and Asian regulators also set stricter standards.

Increased regulation and standardization of disclosure and reporting standards should provide greater impact transparency and offer investors access to more material information, helping the field become more effective and trusted over time. In the meantime, investors must continue to be diligent in their investment selection and move beyond labels to assess an investment strategy’s impact credibility. Our Investment Team does not make investment decisions based on marketing; we believe that our due diligence and impact investing experience enables us to better discern the authenticity, quality and effectiveness of a manager’s approach to generating impact.