If a Democratic “blue sweep” were to happen in the upcoming November elections, with the White House and Senate both under Democratic control, we could see new tax policy in 2021-2022 for higher-income Americans and corporations. The level of change could be significant and disrupt the short-term trajectory of some of the best-performing sectors so far in 2020, such as technology and healthcare, as investors assess the near-term impact to earnings.

The Democratic proposals for tax reform include raising the US corporate rate, instituting a minimum corporate tax rate, and almost doubling the tax rate on GILTI, which stands for “global intangible low-tax income.” This is the huge amount of income generated by the foreign affiliates of US companies on patents, trademarks, copyrights and other intellectual property that was transferred to those affiliates, often in low-tax countries.

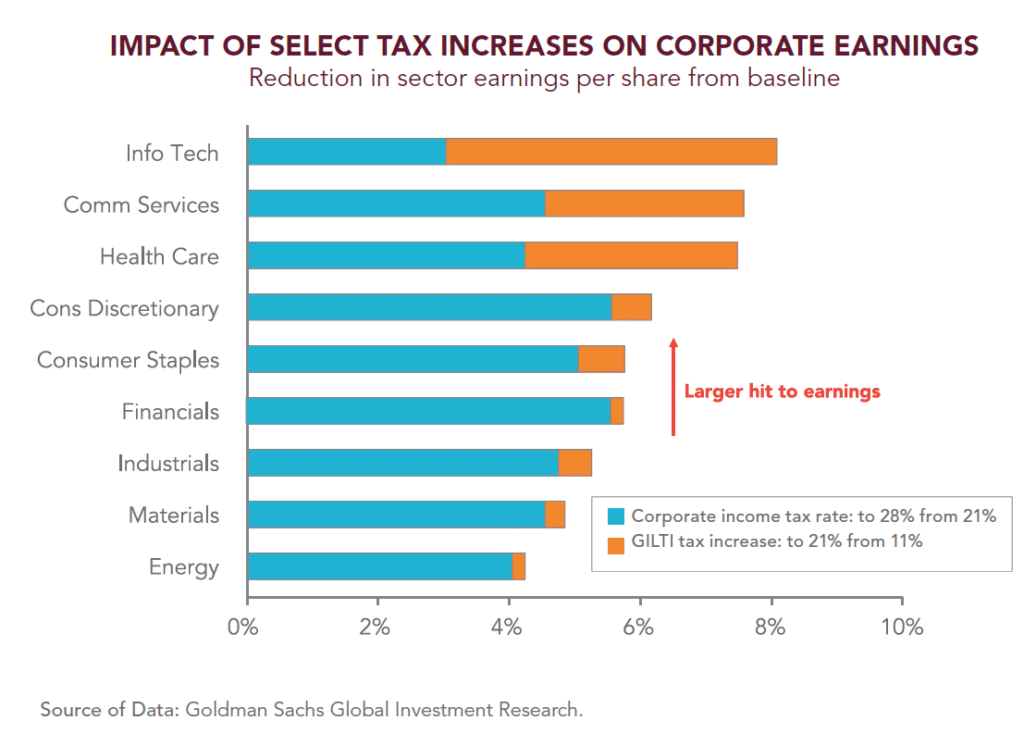

The chart below shows how key sectors of the US economy would be affected if the 2017 corporate tax rate was raised to 28% from 21% (still down from 35% where it was before 2018), and if companies were taxed about twice as much on GILTI. What sector would take the biggest hit? Technology, due to its large amount of GILTI income. Followed very closely by Communication Services and Health Care, three of the best-performing sectors in 2020.

More on the upcoming election and its impact on the markets is in our

Q4 2020 Economic Outlook.